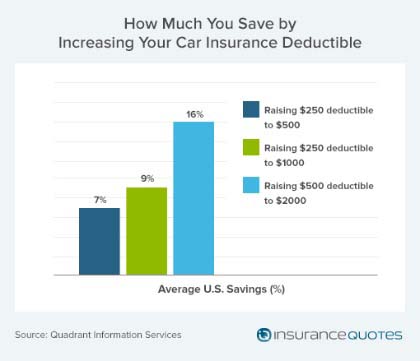

You have to determine the quantity of costs you would have to pay with a higher deductible and also identify if those savings would certainly be worth it. auto insurance. Or else, it's much better to pay higher premiums for a low monetary danger, particularly if your automobile's worth is reduced. Points to Think About When Choosing In Between Car Insurance Policy Deductibles $500 or $1,000 As discussed above, it's essential to do your research as well as contrast the premium amount with an additional insurance deductible to find the right option for on your own.

Besides the $500 and $1000 deductibles, insurance companies supply various other choices that can be preferable for you (cheapest). You could be attracted to go with the lower costs, yet you need to consider the expenses you would need to bear in case of a crash. You may not be able to get the damages covered if you select a $2,500 deductible without having sufficient funds to cover the price.

If you have continual insurance policy and also have a good driving record, decreasing your deductibles might just include around $20 to the regular monthly costs. If you had an accident and filed a crash case, you have actually saved $760. Altogether, you need to go a very long time without an accident case to make your $1000 insurance deductible worthwhile.

The lower the deductible expense, the greater the quantity of costs you'll need to pay every year. The deductibles start from $250. It's finest to consult your vehicle insurance policy company to obtain the right offer, depending upon your scenario (cars). The repayment is another point to take into consideration when you are picking the insurance deductible quantity.

The Basic Principles Of What Is A Car Insurance Deductible? - Credit Karma

If you switch from $500 to $1000 insurance deductible, you'll conserve 10% on your premiums yearly. With a $500 deductible, your yearly costs would have been $800 - vans. Nonetheless, it's mosting likely to be $720 with a $1000 deductible rather. Now that you have actually elevated your insurance deductible by $500, your yearly financial savings total up to $80.

If you do not enter into a crash throughout this period, the boost in the insurance deductible will deserve it. insurance. Nevertheless, if you do enter into an accident, you will certainly pay more expense. It's finest to contrast automobile insurance coverage rates as well as discuss other aspects with your insurance coverage agent to locate the appropriate remedy as well as make a notified choice.

You can conserve around $30 each year when you pay a $1000 insurance deductible in an insurance claim. It's crucial to consider your situation as well as review your options with your insurance policy company to establish if the annual financial savings make feeling.

You have a $1000 deductible, which suggests you will certainly have to pay $800 yourself. If you had a $100 insurance deductible, you would just have to pay $100 and also conserve $700.

What Is A Car Insurance Deductible? - Lemonade Things To Know Before You Get This

At the very same time, you might submit extra insurance claims too. It's really as much as you to decide and also weigh all pros and also cons. To solve the high vs - liability. low deductible vehicle insurance policy conflict, you have to think about the variety of car mishap asserts you have made in the past.

See to it to take into consideration the threats included. As an example, while conserving some money on your premiums is excellent, it could set you back even more to submit a claim. Take into account all the variables, including your driving record, which specify you live in, as well as the threat of all-natural catastrophe or criminal offense price in your location.

Be certain to spending plan the insurance deductible amount in your emergency savings. If you have to cover the fixing costs with your debt card, the high interest rate will certainly eat up the financial savings you could have gotten from boosting the deductible (auto insurance). Establish a long-term plan for cost savings and also financial institution the money you save from the costs.

On the various other hand, a motorist with a poor driving record need to go with a reduced insurance deductible. Wondering how to examine my driving document? The easiest way to inspect the driving document is by contacting your licensing workplace or local DMV. On top of that, many states have made driving records readily available online.

The Definitive Guide to What Is An Auto Insurance Deductible?

Selecting the best insurance deductible amount, depending on your needs and economic situation, can aid you save hundreds on your automobile insurance plan. If you select in between an auto insurance policy deductible of 500 or 1000, think about various variables highlighted in this short article as well as discuss your options with your insurance policy representative. low cost auto.

Rather, do correct study as there are various other methods to reduce insurance costs. What is much better: a higher or lower deductible for automobile insurance coverage?

What is the very best crash insurance deductible? It's ideal to have a $500 crash insurance deductible unless you have a huge amount of cost savings. Keep in mind, this deductible amount has actually to be paid every time you make a collision claim - auto. What is the negative aspect of having a greater deductible? A significant con of a greater insurance deductible is that you may not have the ability to manage a bigger loss.

Allow's speak regarding deductibles. What is an insurance deductible?

Rumored Buzz on What Is A Car Insurance Deductible? - Nationwide

Your insurance deductible is an up front out-of-pocket settlement The buck quantity of your insurance deductible varies, based on the policy you and your American Household Insurance policy agent pick together. All deductibles function the very same.

And when they do, we'll be right here to aid you every action of the means. Wish to find out more concerning how deductibles work or what deductible amount is best for you? Your American Family members representative mores than happy to help. American Family Insurance Obtain a quote at.

Concerning Auto Insurance Plan A cars and truck Insurance plan or an electric motor insurance plan is an agreement between an insurance company as well as a vehicle owner or any person with an insurable rate of interest in a car. In factor to consider for a costs paid by the insurance policy holder, the insurer promises to give monetary defense in case of any kind of losses occurring from a roadway mishap entailing the automobile, and from any third-party obligations occurring from an occurrence including the car. auto.

This is a double-edged sword, as a greater volunteer deductible would indicate a larger quantity to be paid out of your pocket when your cars and truck requires repair. Therefore, you should pick just as much insurance deductible as you can pay for to pay of pocket. When choosing a voluntary deductible, consider just how much can you pay without it having an influence on your other costs.

The 10-Second Trick For Auto Insurance Deductible - Rogersgray

Keep in mind that a marginally greater premium can save you a lot of frustration in instance of an unexpected mishap - insured car. You do not need to fret about setting up for cash when you might already be under considerable stress. Why Deductibles are applied by Auto Insurance policy Providers Vehicle insurance suppliers think that deductibles incentivize the policyholder to be accountable in their handling of the cars and truck.

As a few of the cost of repair work will need to be borne by the policyholder, she would certainly beware in her usage of the possession and, as a result, have the ability to utilize the automobile better (insurers). Furthermore, deductibles discourage insurance holders from filing small claims saving on overhead expenses involved in working out a case.

Consider it similar to this: when a youngster initially obtains a cycle, the parents are bothered with whether she would care for the cycle. Some parents inform their kid that a component of the cost of any fixing the cycle demands will certainly be cut from her spending money. insurance company. This makes the youngster act sensibly and make sure that the cycle remains in excellent condition as a lot as feasible.

What is volunteer insurance deductible in Cars and truck Insurance policy A volunteer deductible is the amount that would certainly have been paid by the insurer under typical problems, but you chose to pay it out of your pocket. Selecting to have a volunteer insurance deductible included in your insurance policy cover reduces your auto insurance policy premium significantly.

Top Guidelines Of How To Choose The Right Car Insurance Deductible - Metromile

You will certainly have to determine on just how much you agree to pay out of your pocket at the time of plan proposition itself. The deductible would be put on every claim you file in the policy duration. The insurer will just pay the part of the case amount that is above the overall volunteer as well as required deductible.

IRDAI regulations have actually fixed the value of compulsory deductible in auto insurance policy based on the cubic capability of the car engine. Today, it is set at 1,000 for autos with a cubic ability as much as 1500cc, as well as at Rs 2,000 for better cubic capability. The obligatory deductible does not have any effect on the automobile insurance coverage costs.

When to go with deductible auto insurance policy? The quantity of deductible you opt for relies on your comfort level and the quantity of threat you want to take. When choosing a voluntary deductible, take into consideration if you have a sufficiently large reserve offered. You do not intend to deplete the fund, if it is tiny, when you can prevent the exact same.

If you possess an expensive vehicle the premium for the auto insurance will be high also. It might make good sense to choose a little deductible so regarding minimize the costs. Bear in mind that you would anyways not make small cases to develop your no case bonus, so it would certainly be sensible to choose a deductible equivalent to that amount for which you would certainly anyways not sue.

The smart Trick of Car Insurance Deductibles & How They Work That Nobody is Discussing

Do you have to pay the deductible if the mistake is not your own? You just have to pay the deductible on the claim that is paid out by your insurance provider. If an additional party is discovered to be liable, their insurance policy would certainly spend for the problems and you will certainly not need to pay any kind of deductible.

Exactly how does insurance coverage deductible works under vehicle insurance? An insurance deductible is the amount that you have to pay per Home page case before the insurance firm spends for the remainder. If you file a claim for Rs 10,000 and also the deductible is Rs 1,000 the insurance firm will only pay Rs 9,000 as well as you will have to pay the remainder out of your pocket.

You can also go with voluntary deductible this does not have any type of ceiling. What are the deductibles for industrial auto insurance coverage plan? The mandatory deductible for business cars and truck insurance coverage plan continue to be the exact same as for individual auto insurance coverage plan - insured car. You can also go with voluntary deductible based on your convenience to lower the automobile insurance costs.